In the first five months of 2023 Romania produced, 3.9% less crude compared to same period 2022; and crude oil imports rose 10.3% above those recorded in the first five months of 2022

.

According to the latest Energy Balance Forecast, published by CNSP, 2023 crude oil production is expected to shrink by 2.3% compared to 2022

The National Strategy and Forecasting Commission indicates that Romania’s crude oil production will be on a downward trajectory in the period 2023-2026, with an average annual rate of -2.2%, a consequence of the natural decline of deposits and the maintenance of existing production units

.

If Romania’s crude oil imports increase significantly in the future, it could have several implications for its oil prices.

Some possible scenarios are:If the global oil market is tight and supply is constrained by factors such as OPEC+ cuts, sanctions, conflicts, or natural disasters, Romania could face higher oil prices and increased vulnerability to supply shocks. This could hurt its economic growth and fiscal balance, as well as increase inflation and social discontent.

If the global oil market is balanced or oversupplied, Romania could benefit from lower or stable oil prices, which could boost its economic activity and consumer spending. However, Romania could also face increased competition from other importers, especially in Europe, and may have to diversify its sources of supply to ensure energy security and reduce dependence on a few suppliers.

If Romania develops its own domestic oil production, especially from the Black Sea resources it could reduce its reliance on crude oil imports and improve its trade balance. This could also give Romania more leverage in negotiating with its suppliers and increase its energy security. However, Romania would still be exposed to the fluctuations of the global oil market and may have to invest heavily in infrastructure and technology to develop its oil sector

.

According to the information I found, Romania’s crude oil reserves in the Black Sea are estimated to be around 420 million barrels. However, there is potential for more exploration and discovery, as the Black Sea is a large and complex basin with diverse geological features. Romania has been producing oil and gas from the Black Sea since the 1970s, but most of the fields are mature and declining.

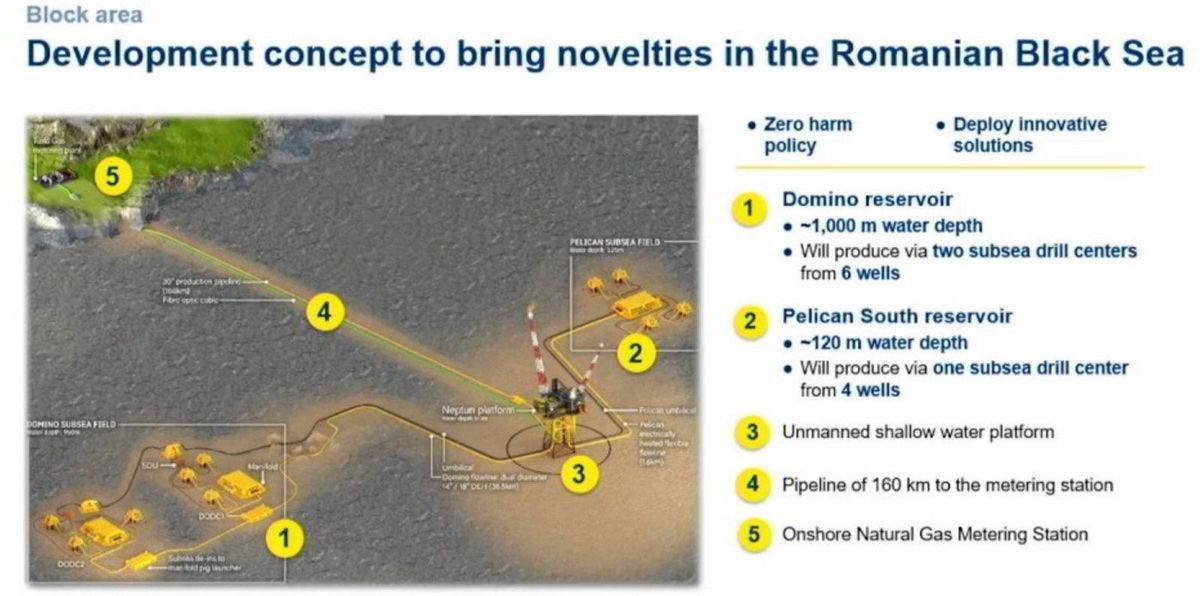

One of the most promising projects is the Neptun Deep perimeter, which covers an area of 7,500 square kilometres and is located about 160 km from the Romanian shore in waters between 100 and 1,000 meters deep3. The Neptun Deep perimeter contains two commercial natural gas fields, Domino and Pelican Sud, which have a combined estimated resource of about 100 billion cubic meters of natural gas3. The development of these fields could start in 2027 and produce about 8 billion cubic meters of natural gas annually for nearly ten years. This would make Romania the largest natural gas producer in the European Union and also allow it to export gas to neighboring countries, such as Moldova.

The development of the Neptun Deep perimeter requires significant investment and infrastructure, such as wells, pipelines, platforms, and a digital twin system for remote operation. The project is operated by two energy companies, OMV Petrom and Romgaz, which have equal shares of 50 per cent of the perimeter. The two companies announced their plans to invest up to 4 billion euros for the development phase of the project in June 20233. The project also faces some challenges, such as environmental concerns, regulatory uncertainty, and geopolitical risks.

In conclusion, Romania has substantial crude oil reserves in the Black Sea, but they are not fully explored or exploited. The Neptun Deep project is one of the most important initiatives to develop Romania’s offshore resources and enhance its energy security and competitiveness. However, the project also involves high costs, technical difficulties, and potential conflicts.